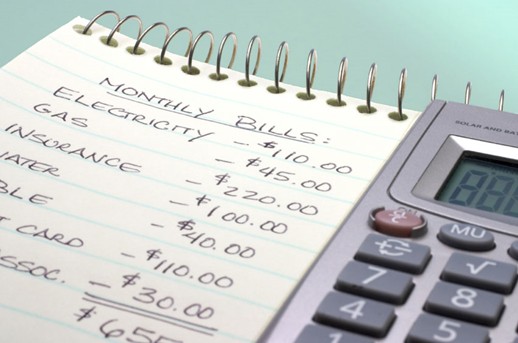

One of the most common New Year’s Resolutions is actually cutting back on monthly spending. Although many people choose to target the items they splurge on, you may find that there’s a whole lot of money hiding in all of the bills that you pay each month. With a quick look at your budget, you may find that there’s a whole lot of changes you can make that will cut back enough money so you can save thousands each year. With the budget cuts working to boost your savings, you’ll ensure your lifestyle is a lot more frugal without even having to cut back on some of the luxuries that benefit your life. So, pull out your bills and get ready to leave your budget smiling as you skip out on some of the high costs.

1. Cable

If there’s one thing on your list that you simply don’t need to spend a fortune on it’s definitely cable. Cable companies really can hike up the prices to leave you spending hundreds of dollars each month on channels that you probably won’t even watch half of the time. They may even lure you in with a decent price at first and then hike up the price when the first year of service is over. There are alternatives to the cable scheme though. Luckily, today you can find all sorts of subscription services that won’t leave you spending your last penny on entertainment. Most subscription services range around $10 and offer original shows as well as those you may have found on your cable subscription. Hulu, for instance, has a deal with some TV channels that will allow you to catch shows 24 hours after they air. Netflix produces many original shows and movies and has been getting rights to Showtime shows merely months after the season completes. You can also look into subscriptions like Sling, which brings live TV to your favorite devices for a fraction of the price. Even the big name channels like HBO have come up with their own streaming service to allow people to catch up on their favorite series and movies. With all of these options, you can find a perfect match for you while saving a bundle.

2. Cellphone Contracts

Numerous people overspend on their cellphone service each month too. You may be surprised as to how much you can save by skipping the contract and going straight for a pay as you go plan. This allows you to have a bit more control over your cellphone, for starters. Some months, you can purchase a larger plan if you know you’re going to be on the phone more or if you will wind up browsing the net when you’re on the go. If you don’t plan on keeping up with the phone then downgrade the plan. Best of all, you can also allow family members to have different plans, which will help keep kids off the phone when they shouldn’t be. Sure, you will have to buy your own phone to do this, but you might find there are so many options to choose from that it will be an added bonus to your new found freedom. You can even buy phones that have advertisements on them now, which cost a significant amount less than an average phone with all of the same perks.

3. High Energy Plans

Many regions are trying to offer eco-friendly options when it comes to power use now, so you may be in for a real surprise when you look at your energy plan. Before you renew with your energy company look to see what types of plans they offer. If you are trying to cut back on your electricity consumption, then you can always sign up for a plan that allots you less energy for less money. Sometimes, you can even find plans that will allow you to use wind or solar power opposed to those that create more pollution. If you’re not sure where to begin when choosing an energy plan, then talk to the companies or look up their information so you can make an informative choice. You may even be able to write off some of your energy bill if you use a greener plan. Of course, you may also want to invest in your own solar panels which will substantially cut back on your energy bill to the point that you may even receive a refund.

4. Ditch the Gym

Many people join the gym in order to get a head start on their New Year’s Resolution. However, what they don’t realize is how much of a burden the membership can be on the monthly budget. This is especially true if you don’t always have the chance to get to the gym. With all of the days missed you may find that you truly aren’t getting your money’s worth. There are many cheaper options available though. For instance, you can simply take up walking, jogging or running to get in shape. You can also invest in a home gym for around the same price as your membership. This will allow you to workout whenever your heart desires and you’ll easily get your money’s worth out of the machine before the year’s end. If you want the gym membership for the classes, then check online for freebies. You may be surprised by how many you find.

5. Stop Water Subscription

Many people will spend a whole lot of money to have clean bottled water delivered to their home on a regular basis. These subscriptions might be convenient, but they will also cost you a whole lot more than they should. The alternative is much cheaper though. You can easily fill up your own 5 gallon jugs for a dollar a piece, which is a mere fraction for the amount you would have to pay for the subscription bottles. You may be surprised as to how easy it is to deal with water too. There’s plenty of local water stations in most areas as well as companies that offer their many filters for your use. Apart from that, you can invest in home filters and pitchers to ensure you have the best water in town.

6. Credit Cards

When it comes to handing over money each month, especially after the holiday season, credit cards can be one of the worst culprits. With high spending limits and interest costs, you may find yourself dreading looking at what your payment or even your payoff amount is. There are ways to get around this though if you’re willing to do some shopping around for a new credit card company. Some companies will offer you the ability to swap your debt to their card at no transfer price. This is a great way to get your debt in one area so you only have to work on one payment a month. Not to mention, if you can find a card with a better interest rate then this will work out in your favor too. If you can’t find a card willing to transfer your debt then simply look for one with better interest. As your credit score grows this shouldn’t be an issue as most companies will try to find you. With the better interest in your pocket you can pay off your other cards and use only the one that won’t have you spending a whole lot of extra money.

7. Travel

For many, buying gasoline is one of the priciest expenditures on the monthly budget, which can be a real problem as the price of gas tends to fluctuate throughout the year. One way to remedy this problem is to take your car out less than you normally would. If you can, set up a carpool to take the kids to and from school and do the same if you need to commute to work. This will shave off a good portion of the gas you use and will help the environment and your community out. Apart from carpools, you may also want to consider public transit. This great alternative will get you out in the community while helping your city and your environment. There is also the option of walking or cycling around town, which will improve your health. The more options you consider when it comes to getting around town, the more likely you are to save money. This doesn’t just mean on gas though. Using your car less can help your health, allow you to apply for more tax deductions and may even cut your car insurance payment down.

8. No Takeout

It may be hard, but cutting out your monthly takeout bill will put a whole lot of money in your pocket. You may be surprised by how much as well since it doesn’t seem like we’re spending too much when we order out or pick up coffee. For many, takeout is a staple that they use to get through lunch every day. This doesn’t just mean grabbing a bite to eat at a restaurant or fast food chain, but also picking up prepackaged salads, sandwiches and other meals at local stores. By making your lunch at home you’ll be able to use healthier options and spend a whole lot less on the food you buy. The same can be said for dinner. If you feel like you don’t have time to cook, then consider whipping up premade meals on your days off or utilizing the crock pot. It won’t take long to get into the habit of doing this and the savings will leave you feeling amazing.

9. Skip Subscriptions

Subscriptions have become a big part of our lives as they have expanded from simple newspapers to boxes of goodies that surprise us each month. One way to ditch some of the extra spending each month is to also get rid of the subscriptions. Most newspapers and magazines can be purchased online, which not only cuts down on the price you pay for them, but also helps alleviate the clutter in your home and how much you need to recycle each week. Apart from these items, if you’re subscribed to gaming, book, pop culture or other subscription boxes then you may be forking over a lot of money for items you probably don’t even want. Instead, take a fraction of the money and put it back to splurge on an item you may actually want to own. This will cut back on the junk in your home and allow you to feel like you’re making positive changes in your life. Another subscription you may want to ditch this year is food subscriptions. You can easily look up the recipes for your food boxes and buy the food locally. This will cut back on the price and will help out local farmers.

10. Adjust Taxes

Recently, the IRS announced that people should start adjusting their taxes at work if they didn’t want to wait a while for their tax refund. This can be a quick and easy step to putting more money in your own pocket each year too. Many people are actually overpaying the government for their taxes, which is why they get a hefty sum at the end of the year. Talk to your employer to see how your taxes are being paid and what steps you need to take to ensure you’re paying enough without overpaying.

Monthly bills are never any fun to process, but with these simple steps you should be well on your way to putting money back in no time. After you reduce the amount you spend on these ten items, you’ll be amazed by how much money you actually have to play around with in the New Year.